A growing number of online casinos, particularly in the crypto space, are no longer relying solely on established game studios to supply their content. Instead, they are building and promoting their own in-house games, commonly referred to as “originals”. What started as a handful of simple mechanics has quietly evolved into a parallel content model that now competes for player attention alongside traditional slots and live casino titles.

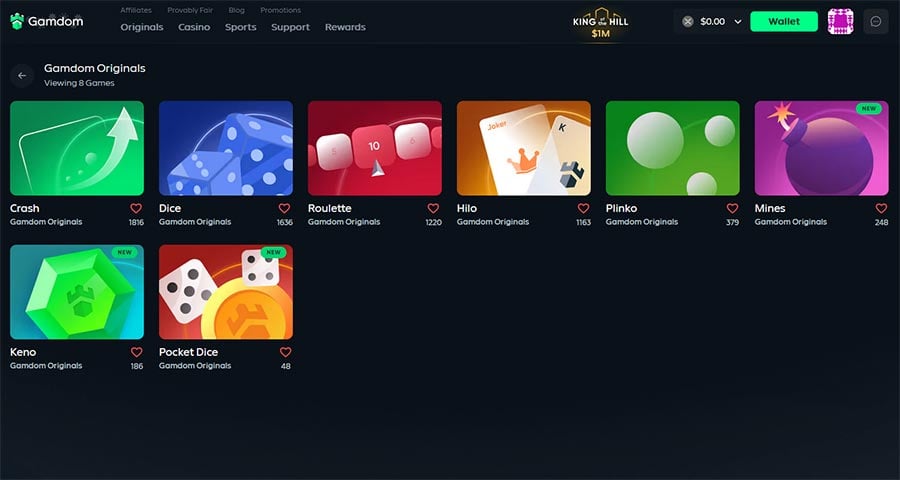

The latest example comes from Gamdom, which recently announced that all of its Originals now operate at a 100% Return to Player. The update applies across its in-house portfolio, including games such as Crash, Dice, Mines, Plinko, Keno, and Roulette. By supposedly removing the theoretical house edge entirely, Gamdom is positioning these games as statistically neutral over time, a notable contrast to the 95-97% RTP range that dominates most regulated casino content.

RTP, or Return to Player, represents the percentage of wagered funds a game is designed to pay back over the long term. While short-term results remain governed by variance, a 100% RTP model signals that the casino does not expect to profit directly from the game’s math. In practical terms, this does not guarantee winning sessions, but it does alter how these games are framed and perceived from a marketing perspective.

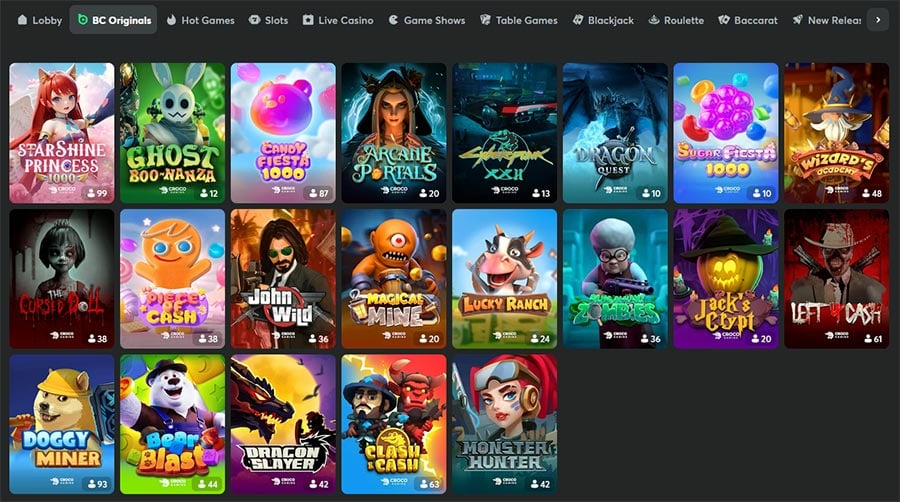

Gamdom’s move is not happening in isolation. Stake has spent years developing and refining its own Originals, turning minimalist concepts into some of the most recognisable games on its platform. BC Game has followed a similar path with its Croco Gaming suite, gradually expanding its internal catalogue while keeping it entirely separate from third-party providers. In each case, the strategy is the same: full control over development, distribution, and accessibility.

One of the defining characteristics of casino originals is that they exist largely outside the traditional regulatory framework that governs licensed game studios. Because these games are built and hosted internally, they are not subject to the same jurisdiction-based restrictions that often limit where slot titles from studios like Nolimit City, Pragmatic Play, or Hacksaw can be offered. For players in restricted or grey markets, originals are often accessible when mainstream content is not.

This raises an uncomfortable question for established providers. Are they under threat?

Generally speaking and in the short term, the answer is no. High-production slots, branded games, and live dealer products have traditionally offered a level of audiovisual polish and narrative depth that casino originals did not attempt to match. Originals were long associated with fast, repeatable mechanics and mathematically transparent gameplay rather than full-scale entertainment experiences.

But that gap is narrowing. Studios such as Croco Gaming have already released in-house titles like Super Waldo and Bear Blast whose production quality, animation, and overall presentation stand comfortably alongside games from established providers. What was once a clear divide between “casino tools” and “studio games” is becoming increasingly blurred, particularly as internal teams gain experience and invest more heavily in game design rather than pure mechanics.

However, the competitive pressure does not come from substitution alone. It comes from time allocation. Every minute a player spends on an in-house game is a minute not spent on third-party content that carries licensing fees, revenue sharing, and regulatory overhead. As originals become more prominent, casinos gain leverage by reducing their dependency on external studios without removing them entirely.

The 100% RTP model further strengthens that leverage. Even if casinos are not profiting directly from these games, they benefit indirectly through increased engagement, longer sessions, and a stronger platform identity. Originals become part of the casino’s brand rather than interchangeable content sourced from a shared provider pool.

What is emerging is not a replacement for the traditional game provider market, but a parallel one. A segment of iGaming that operates with different constraints, different economics, and different expectations. For now, this ecosystem is largely confined to crypto casinos, but the underlying incentives are not exclusive to that sector.

Gamdom’s announcement may not mark a turning point on its own, but it does underline a broader shift. Casinos are no longer just distributors of content created elsewhere. Increasingly, they are becoming developers in their own right, reshaping how value, control, and fairness are presented to players.

Whether this trend remains a niche feature of crypto platforms or evolves into a lasting structural change for the industry is still unclear. What is clear is that casino originals are no longer a novelty, and established studios can no longer afford to ignore them.